While CleanFi attempts to provide useful financing-related information in various ways, CleanFi is not a tax authority nor is CleanFi licensed to dispense tax advise. Please consult a professional, license tax advisor for verification of this information, and beware that tax law is subject to change, interpretation and updated guidance from the Internal Revenue Code.

Let’s talk Depreciation.

It’s the significant “other” benefit available to for-profit entities doing renewable energy improvements on their properties. It can amount to around 15% of the project value (depending on the tax bracket of the claimant), so it is significant when forecasting cashflow over the first few years of the proposed solution. What’s at stake here is when and how much of that depreciation you can take in the first year. The impact could be meaningful for projects already returning tight cashflow analyses.

The 2022 Inflation Reduction Act (IRA) reset the clock on the way to depreciate renewable energy (and many other) investments into hard assets, but a new clock began ticking impacting accelerated depreciation, prevailing wage requirements and other important aspects of costing calculations for such expenditures.

Here, let’s look at how the new depreciation schedule favors the early bird looking for that tax worm.

For clean energy projects receiving an Investment Tax Credit, the filing entity must reduce the project’s depreciable basis by one-half the value of the ITC, then apply the appropriate depreciation schedule.

Currently, depreciation of solar, energy storage, wind energy and many other qualifying investments is using two primary methods concurrently:

Bonus:

A category of depreciation known as “accelerated”, bonus depreciation allows a business to write off all or part of an asset’s cost in its first year of use. But it is a disappearing act.

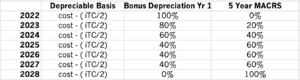

As of IRA’s inception, a company could write off 100% of qualified equipment costs (cost – ITC value/2) via bonus depreciation in 2022. This percentage dropped to 80% in 2023, 60% in 2024, and 40% in 2025, until its wholly phased out in 2028.

So, in 2024, a $1Million project will be able to immediately depreciate ((Project value – ITC/2) * 60%) = $510k , or $170k less than in 2023.

The remainder of the value will then be eligible for MACRS depreciation.

The “Placed In Service” year is when the Bonus applies:

The question often arises as to when (what year) the ITC applies, and when the Depreciation begins. All interpretations of the IRS statutes point to ITC being anchored to the date the project was begun, subject to the “Continuous Work” or the “Continuous Effort” tests; meaning, the project was started on a specific year, and its owner was insuring that work or effort was continuous and uninterrupted up until the project was put in service (given “Permission To Operate” from the local utility, or commissioned as a microgrid). The Depreciation schedule, on the other hand, begins at that point, when the installation is actually put to its intended use.

This is particularly important if you have claimed Safe Harbor for the starting date of a project.

MACRS:

This is the method that is used to depreciate the balance of the allowed amount.

A number of renewable energy technologies are classified as five-year property (26 USC § 168(e)(3)(B)(vi)) under the MACRS, which refers to 26 USC § 48(a)(3)(A), often known as the energy investment tax credit or ITC to define eligible property. Such property currently include:

- a variety of solar-electric and solar-thermal technologies

- fuel cells and micro-turbines

- geothermal electric

- direct-use geothermal and geothermal heat pumps

- small wind (100 kW or less)

- combined heat and power (CHP)

- the provision which defines ITC technologies as eligible also adds the general term “wind” as an eligible technology, extending the five-year schedule to large wind facilities as well.(source)

The modified accelerated cost recovery (MACRS) allows businesses to recoup part of these costs more quickly than through a normal depreciation schedule. This schedule can run 5 or 6 years (depending on when in the federal fiscal year the equipment was placed n service), with over 50% of the total depreciable amount applied in the first two years. So, in addition to the first year bonus depreciation, the first year of MACRS also provides a depreciable value.

Source: Bloomberg tax

Depreciation schedule:

In conclusion:

Per the above schedule, companies electing to install solar in successive years will not lose any deduction value over installation in 2023. But they will lose an increasing portion of the amount they can deduct in the first year.

Are Adders subject to Bonus Depreciation?

Generally speaking, ITC Adders are also subject to Bonus depreciation, but they also reduce the basis for depreciation in the first place, because they increase the amount one must deduct from the cost of the system before applying the depreciation schedule.

Use CleanFi’s free Bonus and MACRS Calculator:

We have built a simple, quick and easy calculator for you to download and use as yours:

Do states conform to the Federal Bonus Depreciation schedule?

For a list of how various states apply Bonus Depreciation, see this informative Reuters recap that provides an excellent table of reference:

https://tax.thomsonreuters.com/en/glossary/bonus-depreciation#six

Note that CleanFi.com does not calculate depreciation on its finance quoting platform.

© 2023 – Philippe Hartley and CleanFi – Authorization not granted for this content to be used by AI bots, scrapers, readers or other information amalgamators, except if pointed to directly as a reference.