CleanFi is providing this information for general informational purposes only. CleanFi is neither a licensed accounting practice nor a qualified legal advisor. What follows is an overview of certain IRA tax provisions for general informational purposes only and is not itself tax guidance nor posturing as such. Simplifications and generalizations are meant to convey high-level points about IRS tax provisions. Please refer to guidance issued by the IRS for detailed information on the rules associated with IRA tax provisions. Reference Links: IRS.gov/CleanEnergy ; IRS.gov/ElectivePay ; CleanEnergy.gov/DirectPay

Direct Pay is a marketing name, or informal name for the program for which the official IRS/Treasury name is Elective Pay. They want to make it absolutely clear that there is nothing automatic or direct about “Direct Pay”…you have to work for it, per below.

Also, there is a lot of (understandable) confusion between “Direct Pay” and “Transferability” of the Investment Tax Credit (ITC), both new tax law features voted into law through the 2022 Inflation Reduction Act.

Transferability is covered in this other CleanFi Knowledge Base piece, and it applies to “for-profit” entities which cannot use any of the tax benefits of the IRA programs. They then need to monetize them by selling them (a ).

Here we focus on Direct Pay, where the US government (via Treasury) compensates those entities that do not pay Federal Taxes (thus cannot take advantage of “tax credits”) for their investment into a wide variety of renewable energy-related measures by paying them “directly” the equivalent of the eligible Investment Tax Credit once a) the project is completed and b)the entity files their annual statement with the IRS.

The IRS Reference sheet on the subject, of course, is a “must” consultation if you are getting deep into a project and are concerned about some nuances:

Eligible entities:

“The final regulations provide that any organization described in sections 501 through 530 that meets the requirements to be recognized as exempt from tax under those sections is eligible for elective pay. This includes, among others, all organizations described in section 501(c), such as public charities, private foundations, social welfare organizations, labor organizations, and business leagues.

It also includes homeowners associations exempt under section 528.”

Also, this 4/2024 updated language from the IRS: “Generally, only ‘applicable entities’ are eligible for elective pay. However, there are special rules for three of the clean energy tax credits. Specifically, other taxpayers that are not ‘applicable entities’ may make an election to be treated as an applicable entity for elective pay with respect to the applicable credit property giving rise to 1. The section 45Q credit (credit for carbon oxide sequestration), 2. The section 45V credit (credit for production of clean hydrogen), or 3. The section 45X credit (advanced manufacturing production credit). There are additional rules if the taxpayer is a partnership or S Corporation.

NOTE that the IRS frequently issues fresh guidelines for this category of benefits. This post could be out of date. For the latest language directly from the IRS, please refer to https://www.irs.gov/credits-deductions/elective-pay-and-transferability

Entities wishing to claim “Direct Pay” need to complete the following steps:

Step 1: Identify the project and the credit you want to pursue (see below for all credits).

Step 2: Complete your project, place it into service, and determine the corresponding tax year (Look for “Safe Harbor” or “Placed in Service” in the Knowledge Base).

Step 3: Determine when your tax return will be due.

Step 4: Complete pre-filing registration with the IRS before your tax return is due.

See links at the bottom of this page for instructions and forms.

Step 5: Once you receive a valid registration number, file your tax return by the due date (including extensions).

Step 6: Receive your direct payment.

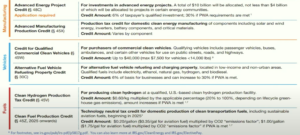

Applicable Tax Credit for Direct Pay (Elective Pay) source: US Treasury

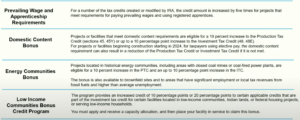

ITC Bonus – Eligible Conditions (see Knowledge Base articles for # 3 and #4)

Special Rule of Using Grants and Forgivable Loans with Direct Pay:

A project which receives a grant or forgivable loan must have a net payable on the project value of at least the amount of the Direct Pay in order to receive the full value.

So, if a project costs $400,000 and a grant of $300,000 is contributed, the Direct Pay for the improvement cannot exceed $100,000.

Rules about Ownership of Credit-Generating Property:

(See the IRS link above for more on this)

The applicable entity or electing taxpayer generally must own the property that generates the eligible credit (or otherwise conduct the activities giving rise to the underlying eligible credit). That ownership can occur through various structures. For example, an applicable entity or electing taxpayer could directly own the property, could own it through a disregarded entity, or could own an undivided interest in an ownership arrangement treated as a tenancy-in-common or pursuant to a joint operating arrangement that has properly elected out of subchapter K of chapter 1 of the Code (subchapter K) under section 761.

Partners of partnerships – Conditions of eligibility. A partnership, even if all of the partners are applicable entities, is not an applicable entity. However, a partnership can make the elective pay election if it qualifies as an electing taxpayer with respect to the section 45Q credit, the section 45V credit, or the section 45X credit. According to Renewable Energy World’s reporting, there is also a pathway to eligibility that includes electing out of a partnership tax treatment. Per the publication, “Specifically, these proposed regulations would:

- Permit renewable energy investments to be made through a noncorporate entity, rather than requiring direct co-ownership of the property or facility by the applicable entity;

- Modify certain joint marketing restrictions to provide that multi-year power purchase agreements would not violate the requirements to elect out of partnership tax treatment.”

When, where and how to register:

Allow time for the IRS to review your submission. In general, you should register:

- After placing an investment property or production facility in service, but no earlier than the beginning of the tax period when you earn the credit.

- At least 120 days before the due date (including extensions) for the return where you report the credits. Use the form identified in the instructions for your form of annual return to apply for an extension of the time to file your return.

INSTRUCTIONS TO REGISTER FOR DIRECT PAY:

https://www.irs.gov/credits-deductions/register-for-elective-payment-or-transfer-of-credits

FORMS TO REGISTER FOR DIRECT PAY:

https://www.irs.gov/pub/irs-pdf/p5884.pdf

[end of article]