What is a PPA?

A Power Purchase Agreement (PPA) is method of financing a power plant. It involves a third-party investing into the construction and operation of a power generating facility in which the user of the energy is a customer, not the owner. Typically, PPA’s involve one investor and one “Off-Taker” (the client to whom the PPA Operator is selling the energy) agreeing to a 15 to 30 year contractual relationship in which the PPA Operator agrees to sell the yield from the power plant for a set price or pricing schedule. The Off-Taker can be a power utility or a private entity, or an individual.

PPA’s are now commonly used as a way for corporate entities (both for-profits and non-profits) and municipal entities to secure a predictable energy supply from a source other than their local utility, by hosting the power plant on their own property in exchange for a land or roof lease agreement to the PPA Owner/Operator. In those situations the buyer of the energy is known as both the Host and the Off-Taker. The Host’s motive could be cost savings, power reliability, environmental objectives, a combination of those and/or other factors.

Solar energy is the most common application of PPA contracts currently at the Commercial and Industrial level, but any other energy supply, such as combined heat and power (CHP), hydrogen, thermal, hydro, storage, can be subject to such an agreement.

What are the advantages of a PPA?

👍🏼 For an Off-Taker, the advantage is that ideally the solution is turn-key Save for the inconvenience of having the plower plant built on their own premises, causing temporary disruption, the access to the power thereafter is turnkey and maintenance free. There really should be no difference at all from using power coming in from the utility, from a practical stand-point.

👍🏼 The Off-Taker has no maintenance obligations whatsoever. If the power plant fails to produce power, it is the PPA Owner/Operator who has the responsibility to make what ever repairs must be made, at their own expense.

👍🏼 The Off-Taker now inherits a predictable cost of energy, also known as “normalized energy cost”, for the duration of that PPA agreement, and for the anticipated amount of power that the subject plant is expected to produce. Since there are no maintenance costs (unless contractually obligated to in the agreement with the Owner – i.e., panel washing), the Off-Taker can budget the equivalent of power costs far into the future without being at the mercy of utility rate hikes.

👍🏼 At the end of the PPA agreement, the Off-Taker often inherits the power plant for a nominal fee. For solar plants, this can be a significant bonus as the panels are often rated to continue operating at about 75% of original production capacity at that time in their life cycle.

👍🏼 From a financial/accounting stand-point, a PPA delivers the advantage of having i.e., an on-premise solar plant without having a loan liability on the balance sheet. It is basically an “off-balance sheet” method of securing a “on-location” power plant while treating it as an operating expense.

What are the Disadvantages of a PPA?

👎🏼 In the case of solar, energy storage and many other renewable sources, the US government now offers significant financial rewards and incentive, even grants, for putting in a power plant. The Investment Tax Credit, Direct Pay for non-profits, various ways of having rapid depreciation, additional tax credits such as Energy Communities, Low Income Communities, REAP grants from the Dept of Agriculture, and many other incentives, mean that one can see 50% or much more of the value of the installation cost defrayed. This renders the ownership economics extremely attractive of course. In a PPA, the Off-Taker receives absolutely none of those benefits. All accrue to the PPA Owner in exchange for the “risk” of owning and operating the power plant. Often the financed cost of purchasing a solar plant installation through a loan can deliver much cheaper cost-per-kiloWatt-hour than a PPA.

👎🏼 The Off-Taker is not master of their own domain, and the PPA contract is transferable without consulting the Off-Taker. By allowing a 3rd-party to own and operate a large piece of equipment on their own premises, the Off-Taker is essentially allowing a power utility to operate on their facility. If the relationship is successful, that will not pause a problem. Yet in the course of the long PPA, the contract can be sold, and the Off-Taker is slave to the agreement, no matter who the new Owner is.

👎🏼 If the Off-Taker needs to sell the building in the course of the PPA, the prospective buyer may not want to inherit the PPA obligation for multiple reasons, such as the availability of new technology either more efficient or cheaper, or a shift in economic conditions, or plans to use the property asset in a way that uses the space differently. In that case, the PPA owner can force a costly buy-out.

Can roofing be included in a PPA?

1. Cannot exceed 15 to 20% of the total solar contract;

2. Cannot make the project cost such that it creates a negative cash flow position for the project;

3. Cannot be for roofing beyond the surface area of the solar.

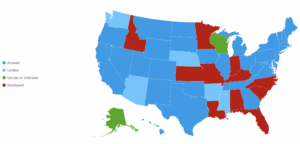

Which states allow PPA’s (a/o 2023)?