(Updated 10/5/2025)

Note that CleanFi no longer presents financiers offering this structure.

In context with the information below, keep in mind that many legal experts feel that the IRS has not looked favorably on the concept of “pre-paid”, unless the buy-out value of the system is left open in the agreement, and the contract is not blatantly designed to provide an “easy out” by the investor at year 6 after the Investment Tax Credit’s “at risk” obligation expires.

A specific user market

(Note that this text was written pre-One Big Beautiful Bill Act of 2025)

Many companies in the US cannot take advantage of tax incentives because they are in a balance sheet situation which prevents access to them. Often times, those companies that do not have a “tax credit appetite” do not show, by nature of the statement, much of a profit if any.

As a result, those in this broad commercial segment can get orphaned from the solar opportunity, even if they have a real desire to generate their own clean energy. They are not candidates for most existing lease or Power Purchase Agreement (PPA) programs because they have difficulty getting the 20-year credit implied by these solar financing mechanisms. In addition to the credit risk they represent, these companies typically need a small to medium solar installation to offset their energy needs, which is often not large enough to sustain the financial underwriting, legal and other professional costs associated with the contract construct designed to minimize “risk” to the investor.

Yet these small-to-mid projects need some value from the ITC to achieve cash flow objectives.

The cash-backed (or “pre-paid”) Operating Lease/PPA

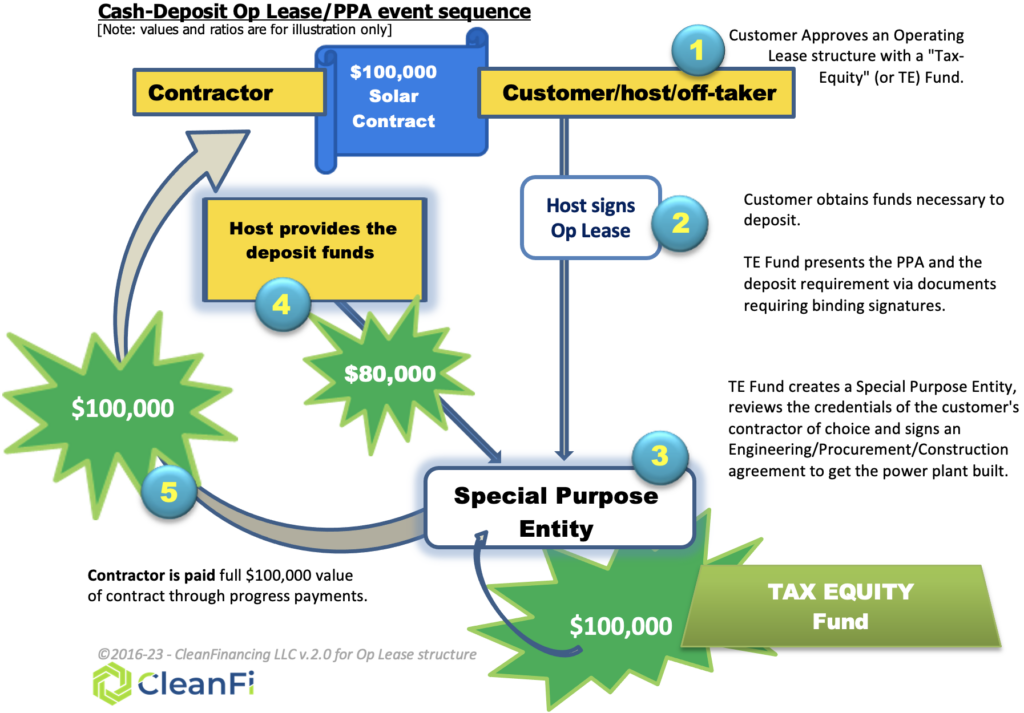

A cash deposit against that future energy off-take significantly reduces that risk and creates interest from investors seeking the tax benefits of the transaction. Here’s how the mechanism works, and how to finance the deposit.

Whether an Op Lease or a PPA is used, the pre-paid structure is created by a tax specialty company which forms a Special Purpose Entity (SPE) that will own the solar project at least for the IRS required hold time of the project to avoid ITC “claw-back” and perhaps other punitive fees. The SPE offers a 20-year (or more) contract to deliver solar energy to the off-taker according to system design specifications. The SPE is funded with tax equity, which will represent the tax investor’s portion of the solar installation contract cost.

The tax partner’s contribution will offset approximately 66% of the ITC value (at the time of this writing – but the market is dynamic) of the solar system installation cost (the remainder of the tax benefits accrue to the tax investor). On larger systems, a larger contribution may be offered. The remainder of the solar installation cost is funded into the SPE via the cash prepayment of the contract by the off-taker.

In some structures, there is an automatic transfer of ownership and operational responsibility to the Off-Taker at year 6 of the contract, specifically stipulated in the Operating Lease agreement.

Key to the attractiveness of these structures for the off-taker are three characteristics of the scenario:

– A third party helps pay for the solar system while the Off-Taker enjoys 100% of its yield.

– Responsibility for Operation & Maintenance of the system is that of the owning SPE until it turns over its operation back to the off-taker who then becomes owner of the power plant;

– Off-Taker has that opportunity to eventually own the system, and possibly receive additional depreciation benefits at the federal or even state level (subject to review by the party’s CPA or CFO).

Financing the deposit

How the Off-Taker secures the funds necessary to make the deposit on the Operating Lease is completely independent of the transaction. The funds can be brought in from cash reserves, a bank loan, a PACE assessment (NOTE: See the article called “How Different Mechanisms Secure Their Risk” for why C-PACE may the the only loan type that will work to avoid the UCC1 lien that will conflict with the tax investor’s) , a gift or a grant, or any other method.

The SPE will not be created until both of these conditions exist: 1. the tax equity partner is ready to fund the SPE and 2.the off-taker is ready to pay the deposit in full.

Once the pre-payment is made, the Off-Taker will have no additional payment to make to the SPE, nor to any other entity for the power used from the solar system for the life of the agreement, unless specifically stipulated otherwise in the Agreement.

The source of the deposit capital may associate a debt requiring servicing, such as a loan or an assessment (or, in the case of cash, an “opportunity cost”). In such case, the annual value of those payments can be looked at as the cost of the energy for that year. Financiers compare that cost against the “avoided cost” of the energy not supplied from the previous utility source; if the Off-Taker saves money by financing the loan over sourcing the energy from the utility over the term of the loan, the investment is said to be cash-flow positive.

The mechanics of a pre-paid or “deposit” Operating Lease

For more information please contact

admin@cleanfi.com

© 2023,2025 Philippe Hartley, licensed to CleanFi

For more information on the various ways to finance energy improvements for buildings, consult the DoE’s Better Buildings website’s Financing Navigator.