While CleanFi does facilitate these transactions in various ways, CleanFi is not a tax authority nor is CleanFi licensed to dispense tax advise. This post is strictly for information purposes.

Transferability of Federal tax credits (both Investment Tax Credits, aka “ITC”, and Production Tax Credits, “PTC”) came out of the Inflation Reduction Act of 2022 (IRA). Transferability is designed to help “for profit” organizations that do not have the appetite to absorb said tax credit.

Transferability is NOT ‘Direct Pay”, which is covered in this CleanFi Knowledge Base article.

Direct Pay eligible properties and projects are not eligible for Transferability. In other words, the cash value of the ITC that the US Treasury gives to a project owned by a non-profit or government entity cannot be sold.

Previously, for-profit entities not able to leverage their ITC only had three options: make the project cashflow without the credit (very hard), get a PPA if they could, or get a co-investor that would take the tax credit via a structure like a pre-paid PPA (executed with ease via the CleanFi platform).

Per the 2022 IRA, the for-profit entity receiving the credit is now allowed to sell for “cash only” some or all of said tax credit value. Note that said Transferability is available only for commercial projects owned by “for Profit” entities. Residential, non-profit and government projects are not eligible to apply the Transferability option.

Transferability involves a deliberate and specific process of IRS filing and declarations, and it is highly advised that the “transferer” (party selling their ITC) work with a tax professional to execute this operation.

Who takes the ITC risk in Transferability?

The IRS has specified that the claw-back risk (IRS’ request for return of funds claimed via ITC due to violation of conditions) sits with the buyer of the ITC, not the seller. Consequently, it is commonly expected that a buyer will want a form of coverage (insurance) against ITC clawback, given that they are fully removed from the ownership, operation and maintenance of the system. This is an oddity of the Transferability rule.

What happens to the depreciation rights on the system in a Transferability scenario?

Sellers of ITC retain all depreciation of the asset. No part of depreciation is sold with the ITC.

Eligibility and Process:

Below are some key graphics and links which contractors, project developers, ITC transferers (sellers) and transferees (buyers) may find quite useful for familiarizing themselves with the key points of the Transferability process.

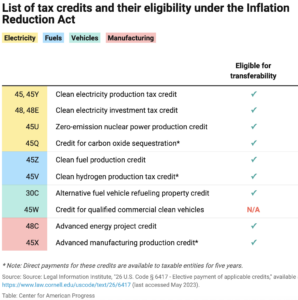

Transferability applies to renewable energy projects but also to numerous other “new energy economy” sectors. Here is a list of credit eligible projects, listed by their IRS section reference:

The IRS provides this excellent FAQ for answering the most common and most burning questions about the process:

https://www.irs.gov/credits-deductions/elective-pay-and-transferability-frequently-asked-questions-transferability

Lifted from that page, here is the process for proceeding through a complete Transferability transaction: (From IRS as of June 14, 2023)

A. There are several steps for transferring eligible credits (or a portion of a credit). Not all steps need to occur in the order displayed below.

- Pursue an eligible project. Identify and pursue a project that generates one of the eligible credits.

- Complete electronic pre-filing registration with the IRS. This will include providing information about the taxpayer, the intended eligible credits, and the eligible credit project. Upon completing this process, the IRS will provide a registration number for each eligible credit property.

- Complete pre-filing in sufficient time to have a valid registration number at the time you file your tax return.

- More information about this pre-filing registration process will be available by late 2023.

- Satisfy all requirements necessary to earn the eligible credit for the tax year. For example, a solar energy project would need to be placed in service prior to earning an eligible credit.

- Arrange to transfer an eligible tax credit to an unrelated party in exchange for only cash.

- Provide the transferee (i.e., buyer) with the registration number and all other information necessary to claim the transferred eligible credit.

- Complete a transfer election statement with the transferee (as described in Q6 below).

- File a tax return. File a tax return for the taxable year in which the eligible tax credit is determined indicating the eligible credit has been transferred to a third party and include the transfer election statement and other information as required by guidance. The tax return must include the registration number for the relevant eligible credit property and must be filed no later than the due date (including extensions) for such tax return.

- If applicable, renew pre-filing registrations and file returns for each subsequent year that a transfer election is made to transfer an eligible credit related to the eligible credit property.

We insert here the link to the IRS form 3800 which the Transferee (buyer of tax credit) must use to apply their credit agains their tax return:

https://www.irs.gov/forms-pubs/about-form-3800

Finally, here is an opinion on the Eligibility qualifier and process from the law firm of Akin Gump, which specializes in transactions in all aspects of the cleantech sector.

https://www.akingump.com/en/insights/alerts/clean-energy-tax-credit-transferability-guidance-issued

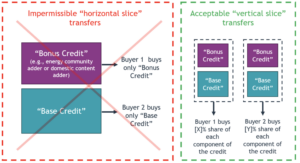

A useful excerpt from the above article is this chart which illustrates how the proper way to split the sales of ITC plus ITC adders and bonuses to multiple parties.