The skinny

Great mechanism for small-to-mid sized businesses equipment financing, in that all tax benefits accrue to the lessee, or user of the equipment. Most capital leases are for short or mid terms, but a few funders offer terms beyond 7 yrs, which can help the cashflow benefits of solar improvements, especially if the project is eligible for ITC Adders (which also accrue to the user of the equipment, not the lender).

People often think of capital leases as similar to Term Loans, because the treatment of tax benefits is the same. The main difference is the way the obligation sits on the books. Many CFO’s prefer a capital lease over an operating lease.

This link includes a handy 90-second video and explanation from Investopedia.

The details

A capital lease, also known as a finance lease, is a type of lease agreement that allows a business to use an asset for an extended period of time in exchange for periodic lease payments. It is called a “capital” lease because it is typically used to finance the acquisition of long-term assets, such as equipment, machinery, vehicles, or property.

In a capital lease, the lessee (the business or individual using the asset) is treated as the owner of the leased asset for accounting and tax purposes. This means that the lessee records both the asset and the corresponding liability on their balance sheet.

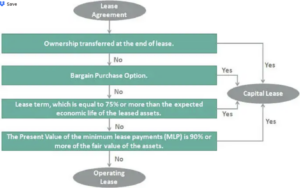

There are certain criteria that must be met for a lease to be classified as a capital lease. These criteria include:

- Ownership transfer: The lease agreement includes a provision that transfers ownership of the asset to the lessee by the end of the lease term.

- Bargain purchase option: The lease agreement grants the lessee the option to purchase the asset at a significantly lower price compared to its fair market value.

- Lease term: The lease term is for a major part of the asset’s useful life. Generally, if the lease term exceeds 75% of the asset’s useful life, it is considered a capital lease.

- Present value: The present value of lease payments (excluding any executory costs) exceeds a certain threshold, typically 90% of the fair market value of the asset.

Chart credit: wallstreetmojo.com

When a capital lease is entered into, the lessee records the leased asset as a fixed asset on their balance sheet and recognizes a corresponding liability for the present value of lease payments. Over the lease term, the lessee depreciates the leased asset and records interest expense on the lease liability.

It’s important to note that a capital lease is different from an operating lease. An operating lease is a shorter-term lease where the lessee does not assume ownership of the asset and does not record the asset or liability on their balance sheet. Instead, the lease payments are treated as operating expenses.

As accounting and tax regulations can vary by jurisdiction, it is advisable to consult with a professional accountant or tax advisor for specific guidance related to capital leases in your particular situation.

The good

👍🏼 Fast underwriting, especially for sub-$250k

👍🏼 All tax benefits go to the user (lessee) of the equipment – credits, depreciation, etc.

👍🏼 Simple buy-out at the end of the term (often $1)

👍🏼 Excellent mid-length loan period (5 to 10 years)

👍🏼 No environmental study required

👍🏼 Can be used for many improvements

👍🏼 Can include soft costs (read CleanFi Option notes for details. Some solutions limit the % of the loan that can be used for non-equipment costs)

👍🏼 Very low minimum funding amount

👍🏼 Progress payments to contractor OK.

👍🏼 Application can be credit enhanced with personal guarantee.

Maybe Not-So-Good?

👎🏼 Shows on Balance Sheet

👎🏼 Progress payments begin 4-to-6 weeks after draw-down of first funds, unless specifically stated.

👎🏼 Generally cannot be pre-paid, not even with a penalty.

For more information on the various ways to finance energy improvements for buildings, consult the DoE’s Better Buildings website’s Financing Navigator.